Islamabad (Web Desk): Prime Minister Shehbaz Sharif on Friday announced that the government has decided to impose 10% "poverty alleviation tax" on large scale industries of the country.

Sectors which will be subject to the tax include; steel, sugar, cement, oil, gas, fertilisers, LNG terminals, banking, textile, automobile, cigarettes, chemicals and beverages.

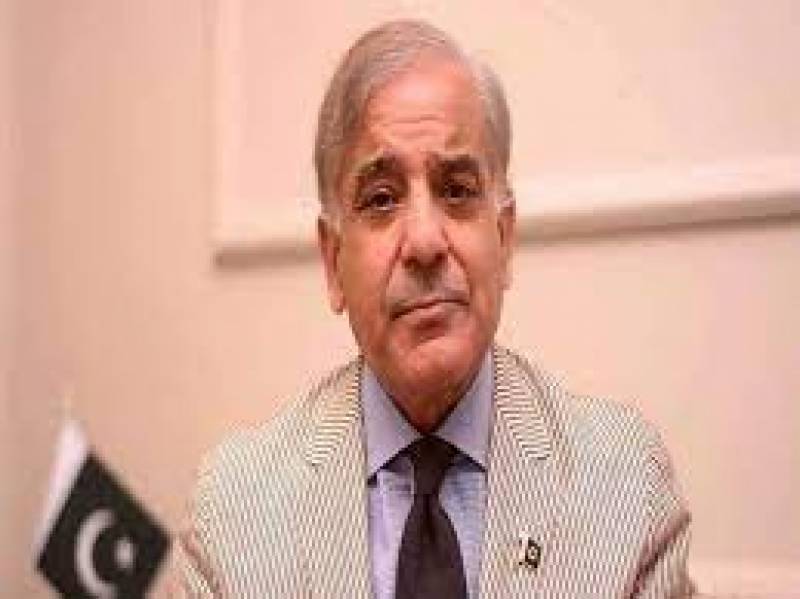

Addressing the nation after chairing a meeting of his economic team in Islamabad, the premier said that the coalition government made "courageous" decisions to protect the country from "serious dangers."

He recalled that the government had two options when it first came to power: call fresh elections or take tough decisions and tackle the sinking economy. "It would have been very easy to leave the public in crisis and become silent spectators like others."

PM Shehbaz said that the government is proposing 4% poverty alleviation tax on the people who earn Rs300 million annually, 3% on those earning over Rs250 million, 2% on people earning over Rs200 million and 1% tax will be imposed on those earning over Rs150 million annually.

The prime minister expressed the hope that soon Pakistan will come out of the economic crisis and announced to provide relief to the poor segment of society.

PM Shehbaz regretted that Rs2000 billion tax is evaded annually. He said the coalition government has taken difficult decision and it has preferred Pakistan over its own politics.

He hoped that affluent segment of society will show generosity and cooperate with the government.