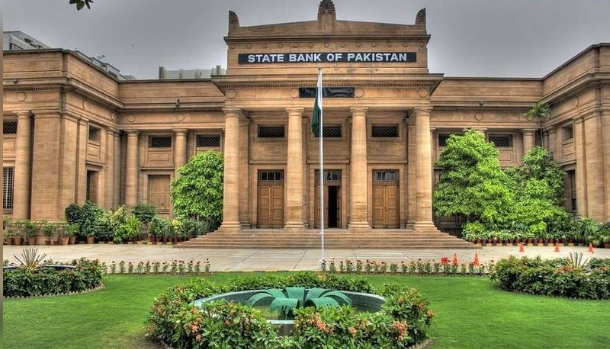

Karachi (Web Desk): The State Bank of Pakistan (SBP) has reduced its key policy rate by 200 basis points, bringing it down from 15% to 13%, effective December 17, 2024.

This decision, announced by Monetary Policy Committee (MPC), follows a favourable inflationary trend, with headline inflation easing to 4.9% year-on-year in November, aligning with the central bank's expectations.

The MPC noted that the deceleration in inflation was primarily driven by lower food price pressures and the diminishing impact of prior gas tariff hikes.

However, core inflation remains elevated at 9.7%, and inflation expectations for both consumers and businesses continue to show volatility.

The central bank indicated that the rate cut is intended to stimulate economic activity while maintaining inflation within controllable bounds.

The MPC also pointed to optimistic signs in the economy, particularly a rebound in agricultural and industrial sectors, with GDP growth projected to be in the higher end of the 2.5%-3.5% range for FY25.

Furthermore, the country’s current account surplus, which has been recorded for three consecutive months, has contributed to an increase in foreign exchange reserves to approximately $12 billion.

The rise in private sector credit is another positive indicator, signaling an easing of financial conditions.

Despite these positive developments, the MPC highlighted ongoing challenges in the fiscal domain, particularly in tax revenue collection, which continues to fall short of targets.

The SBP expressed concern that while broad money growth has slowed, private sector credit has accelerated, which is supporting the recovery.

The central bank's inflation forecast for FY25 has been revised downward to a range of 9%-11%, although the risks posed by persistent core inflation and fluctuations in global commodity prices could pose challenges to the outlook.