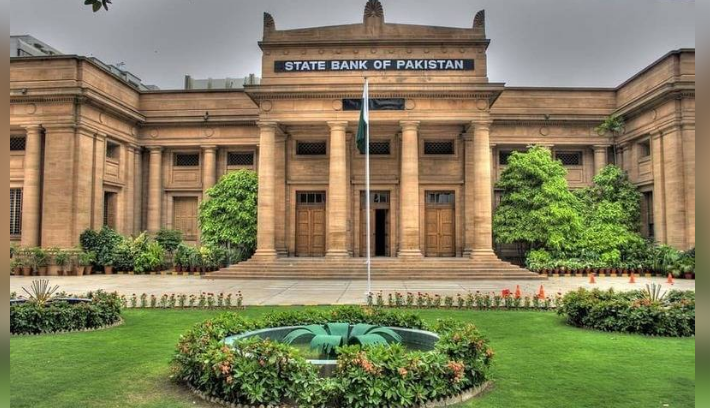

Karachi (Web Desk): The State Bank of Pakistan's (SBP) Monetary Policy Committee (MPC) has opted to maintain the policy rate at 12%, citing the likelihood of a short-term increase in inflation from March to May.

The MPC explained that despite a recent decrease in inflation, the risks stemming from the volatility in food and energy prices could hinder the ongoing downward trend. Core inflation, however, continues to present challenges as it remains persistently high, and any uptick in essential commodity prices could exert upward pressure on inflation.

The committee also acknowledged positive economic signals, with several high-frequency indicators reflecting a recovery in economic activity. However, concerns persist about external sector pressures, primarily due to escalating import levels and insufficient financial inflows. These factors, the MPC noted, continue to pose risks to the country’s overall economic stability.

On a broader note, the committee assessed that the current real interest rate is sufficiently positive in a forward-looking context, which should help sustain the country’s macroeconomic equilibrium.

This decision follows a comprehensive review by the International Monetary Fund (IMF) delegation, which examined Pakistan's progress under its $7 billion bailout program, particularly focusing on revenue targets and potential tax reforms that could influence inflation and the monetary policy stance.

Since June 2024, the SBP has been pursuing a policy of aggressive monetary easing, cutting the policy rate by 1,000 basis points over six months. This strategy helped drive inflation down to its lowest level in over nine years in January, at 2.4%, with expectations for a further decline in February.

However, the persistence of core inflation and the widening current account deficit, coupled with rising market yields, have led analysts to suggest that future rate cuts may not be as pronounced.

If the IMF's review receives approval before the June budget, Pakistan would unlock the next tranche of funding as part of its commitments under the ongoing economic reform program, providing vital support to the country's fiscal consolidation and external stability efforts.